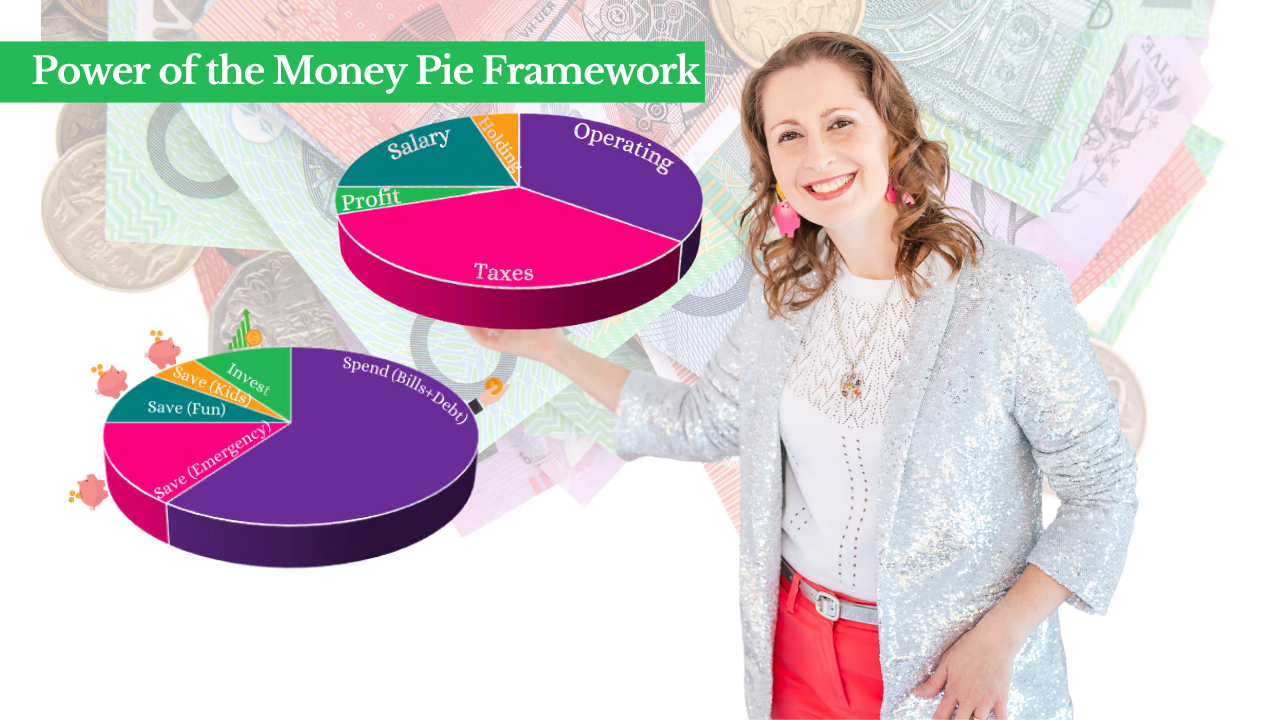

The Power of the Money Pie Framework: Your Path to Financial Self‑Empowerment

Aug 21, 2025Money can feel overwhelming, especially when you’re juggling a business, personal commitments, and life’s unexpected twists. But what if managing your finances could be simple, clear, and flexible? That’s exactly what the Money Pie Framework offers – a practical, empowering way to take control of your money without getting lost in complexity.

I created the Money Pie Framework years ago for my own use, and over time, it’s evolved into a tool I now share with clients. It works because it cuts through confusion and gives you three essential pillars for financial empowerment: Visibility, Clarity, and Flexibility.

1. Visibility: See Where Your Money Really Goes

Visibility means putting your eyes on your money – knowing exactly what’s coming in and what’s going out.

It sounds basic, but for many women (especially business owners with multiple income streams), it’s an eye‑opening step.

In business, it’s not just about revenue – you also need to understand expenses, seasonal fluctuations, and profitability. In personal life, visibility means tracking income, bills, and superannuation.

Too many bank accounts can make it hard to see the big picture. Instead, aim for a manageable number, each serving a clear purpose. This helps you spot issues early, like overspending or upcoming tax obligations, so you can act before problems grow.

2. Clarity: Align Money with Your Vision and Values

Once you can see the numbers, the next step is clarity – understanding what you truly want your money to do for you.

Your goals will change over time: marriage, children, career shifts, or unexpected life events can reshape priorities.

Clarity comes from asking:

-

What lifestyle am I building toward?

-

Are my current financial habits moving me there?

-

What matters most to me right now?

When each “slice” of your money pie is connected to a meaningful goal – whether it’s buying a home, paying school fees, investing for the future, or supporting a cause you love – every dollar has a purpose. This reduces impulse spending and increases your sense of control.

3. Flexibility: Adapt as Life Changes

Life is unpredictable, and your financial system should adapt with you. The Money Pie Framework is designed to flex – you can add, remove, or resize slices as your needs evolve.

One client came to me preparing to leave her marriage. We focused on building her financial independence first. Once she could see she was stable and capable, she no longer felt the need to leave – a powerful reminder that financial clarity can change not just your bank balance, but your relationships and sense of self.

Flexibility also means reallocating money without stress. Want to boost your holiday fund? Adjust your pie slices and watch it grow, all while keeping bills and essentials covered.

The Money Pie Framework gives you freedom without guilt – the freedom to spend on what matters most, knowing you’ve planned for it. It’s about more than numbers; it’s about building confidence, independence, and a future you feel excited about.

If you’re ready to create your own Money Pie and take charge of your financial future, book a clarity chat and let’s get started.